A Greek Drama

How Much Would You Pay for This Company?

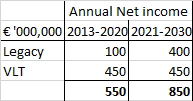

Over the past ten years, it has generated roughly €500m annually for its shareholders. This amount is matched by free cash flow (defined as net income plus depreciation less changes in working capital and less capex) and on average 95% of it has been paid out in cash dividends. Top line growth averaged close to…