A Greek Company That Was Cheap

How Much Would You Pay for This Company?

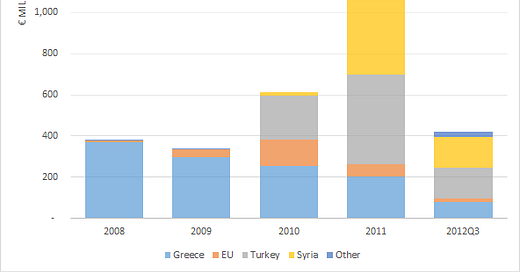

On average, it has generated €40-50m for shareholders over the past 10 years and has paid out 40% of it as a cash dividend. Return on equity is in the high 20s. Equity is leveraged approximately 2.5 times, but mostly thanks to trade payables, not debt. Tangible book value as of the third quarter of 2012 is €35…